LAB

EXERCISE 5: Monthly Sales Tax

Goal:

In this exercise, you will learn how to:

1.

Insert the Main Method (Main Entry Point to the Java Program)

2 Import a Java Class Library

3. Declare Variables

4. Declare Constant Variables

5. Create a Constructor (Special Method)

6. Create Methods

7. Create Objects and Call the Methods

Program

Specifications:

A

retail company must file a monthly sales tax report listing the total sales for

the month, and the amount of state and county sales tax collected. The state

sales tax rate is 4% and the county sales tax rate is 2%. The application should calculate and display

the following:

a. The amount of county sales tax

b. The amount of state sales tax

c. The total sales tax (county plus

state)

In the application’s code, represent the county tax rate

(0.02) and the state tax rate (0.04) as constants (Final Variables). Use the constant variables in the calculation

formulas to compute for the taxes.

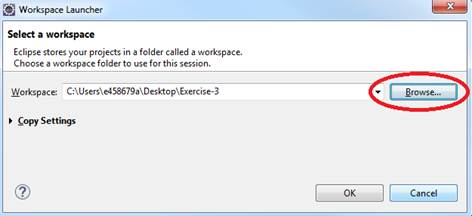

A. Pre-requisites:

1.

Create a folder on your desktop Exercise-5

2. Launch Eclipse

3. Setup your Eclipse Workspace to point to the Exercise-4

folder

a. Select File-> Switch Workspace

b. Browse and select your Exercie-5 folder as your Workspace.

B. Requirements to setup Java Project:

1. Create

a Java Project and name it as MonthlySalesTax

2. Create

the first Class that will have the Main Method

a.

Name the Class as MainApp

b.

Choose the main method to insert into the

class

![]()

3. Create

the second Class that will have the Constructor and Methods

a.

Name the Class as SalesTax

b.

Do not select the main method stub

![]()

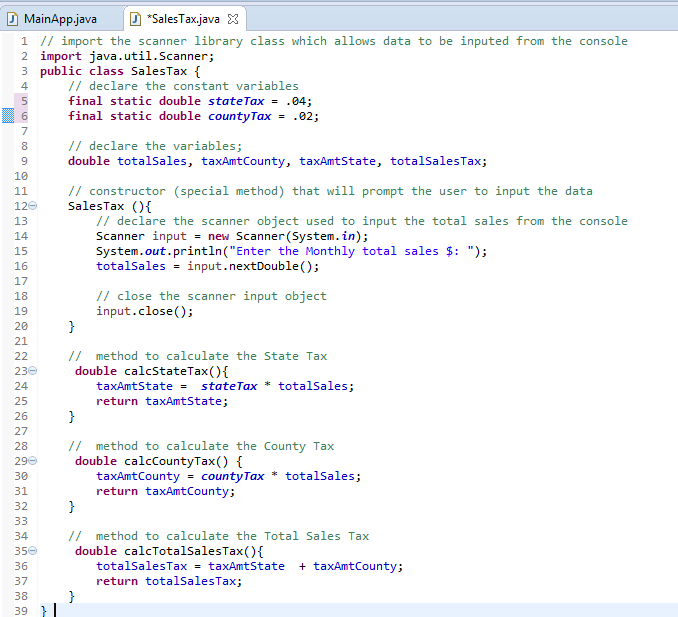

C. Requirements

for the SalesTax Class:

1. Insert

the import java.util.Scanner class

which will allow data to be inputted from the console.

2. Declare

and initialize the Constant variables:

final static double stateTax

= 0.04

final static double countyTax= 0.02

3. Declare

the Class variables- totalSales, taxAmtCounty, taxAmtState

and totalSalesTax

using a double data type

4. Create

the Constructor called SalesTax

a. Declare

the scanner input class objects

b. Prompt

the user to input the data.

c. Assign

the inputted data to the variable

d. Close

the scanner input class object

Below is the code you can copy and paste

|

//

declare the scanner object used to input the total sales from the console //

close the scanner input object |

5. Create

the Method called calcStateTax()

a. This

method should not accept any argument

b. This

method will return a double

c. Insert

the formula taxAmtState = stateTax * totalSales

d. Insert return taxAmtState

6. Create

the Method called calcCountyTax()

a. This

method should not accept any argument

b. This

method will return a double

c. Insert

the formula taxAmtCounty = countyTax * totalSales

d. Insert

return taxAmtCounty

7. Create

the Method called calcTotalSalesTax()

a. This

method should not accept any argument

b. This

method will return a double

c. Insert

the formula totalSalesTax = taxAmtState + taxAmtCounty

d.  Insert

return totalSalesTax

Insert

return totalSalesTax

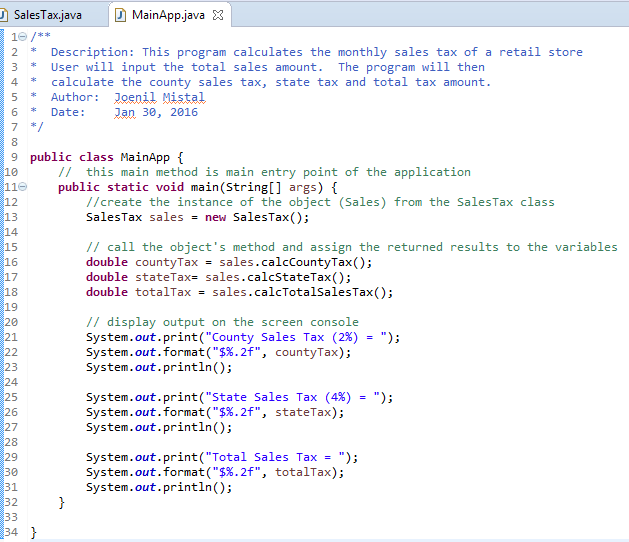

D. Requirements for the MainApp Class:

1. Add

comments (documentation)– Program Description, Author and Date

2. Create

the instance of object called sale from the SalesTax class

3. Declare

the countyTax variable as double and assign the return value from

the called object method- sales.calcCountyTax()

4. Declare

the stateTax variable as double and assign the return value from

the called object method- sales.calcStateTax()

5. Declare

the totalTax variable as double and assign the return value from

the called object method- sales.calcTotalSalesTax()

6. Display

the output on the screen console. Below

is the code you can copy and paste

|

//

display output on the screen console System.out.print("State Sales

Tax (4%) = "); |

E. Test:

1. Save your Java code

2. Compile and run your Java program.

3. Verify there is no syntax, logical or run-time

errors.

4. Use the following set of test data to

determine if the application is calculating properly:

Total Sales County Tax State Tax Total Tax

9500 $190 $380 $570

5000 $100 $200 $300

15000 $300 $600 $900

F. Submit your exercise in the Canvas Lab

Exercise #5 Drop Box.

1. Submit the screen shot of the Eclipse

Workbench window showing the Console output screen.

You can use Paint (save as JPG) or Word to paste the screenshot.

2. Zip up and submit the compressed MonthlySalesTax subfolder that is in the Exercise-05

folder.

NOTE: Right click on the subfolder and select Send

to “Compress Folder”. The file will have

a file extension of .zip.